2019 Annual Meeting Notice & Proxy Statement | Trustmark Corporation

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

| Filed by the Registrant | ☒ | |||

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

Trustmark Corporation

(Name of Registrant as Specified in Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

2019 Annual Meeting Notice & Proxy Statement | Trustmark Corporation

Notice of Annual Meeting of Shareholders

The 20192021 Annual Meeting of Shareholders of Trustmark Corporation (Trustmark) will be held as follows:

DATE AND TIME

Tuesday, April 27, 2021, at 1:00 p.m. CT VIRTUAL ATTENDANCE Due to the public health impact of the COVID-19 pandemic, the Annual Meeting will be held virtually. You will be able to attend, vote and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/TRMK2021 and entering the 16-digit control number printed in the box marked by the arrow on your proxy card or printed on your voting instruction form, notice of internet availability of proxy materials, or email previously received. ITEMS OF BUSINESS 1) To elect a board of 12 directors to hold office for the ensuing year or until their successors are elected and qualified. 2) To provide advisory approval of Trustmark’s executive compensation. 3) To ratify the selection of Crowe LLP as Trustmark’s independent auditor for the fiscal year ending December 31, 2021. |  |

4) To transact such other business as may properly come before the meeting. | ||

RECORD DATE

Shareholders of record on March 1, 2019,2021, are eligibleentitled to notice of and to vote at the meeting in person or by proxy.Annual Meeting.

PROXY VOTING/REVOCATION

Your vote is important. You are urged to vote your shares as soon as possible, whether or not you plan to attend the meeting. Please vote your shares in one of the following ways:

You may vote your shares by Internet by following the instructions on the Notice of Internet Availability or proxy card.

If you received a printed copy of the proxy statement, you may also vote your shares by signing and returning the enclosed proxy card in the enclosed reply envelope.

If you attend the meeting, you may revoke your proxy prior to the voting thereof. You may also revoke your proxy by following the instructions on page 4 of the proxy statement.

Granville Tate, Jr.

Secretary

March 15, 2021

|

P. O. Box 291 Jackson, Mississippi 39205 |

March 15, 2021

Dear Shareholder: On behalf of your Board of Directors, we cordially invite you to attend Trustmark’s Annual Shareholders’ Meeting on April 27, 2021, at 1:00 p.m. CT. Due to the public health impact of the COVID-19 pandemic, the meeting will be held virtually. At the meeting, you will have the opportunity to elect twelve directors who bring diverse perspectives and valuable leadership skills to Trustmark. Their guidance will enable us to successfully compete in an evolving industry and continue our steadfast commitment to the customers, associates, shareholders and communities we have the privilege of serving. Your vote is important to us. The proposals to be considered are described in this proxy statement, and instructions on how to vote your shares may be found on page 4. We encourage you to vote your shares in advance of the meeting to ensure the presence of a quorum. This past year has been an extremely challenging time for everyone. The effects of the COVID-19 pandemic significantly impacted the ways in which we live, work and interact with one another. As an essential business in the communities we serve, our associates quickly adapted and found new ways to serve customers and meet their financial needs during these unprecedented times. Customers embraced our digital banking platforms, and many associates transitioned to a remote work environment. While not without challenges, our associates never missed a beat. We also leveraged investments in technology and learned lessons that have strengthened the organization. During 2020, we continued to build upon and expand customer relationships as reflected by solid growth in our banking, mortgage banking, wealth management and insurance businesses. Net income and diluted earnings per share reached record levels, and we continued investments to enhance our franchise and competitive position. We also returned capital to shareholders through consistent quarterly dividends, and we made significant contributions to strengthen our communities. We invite you to review our Form 10-K and our 2020 Year in Review, both of which are available at investorrelations. trustmark.com or in hard copy upon request. These documents will provide more detailed information about your company. Thank you for your continued support of Trustmark and your participation in this important process. Sincerely, |

|

|  | |

| Duane A. Dewey | |

Executive Chairman |  President and Chief Executive Officer |

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 5 | ||||

| 9 | ||||

Specific Director Experience, Qualifications, Attributes and Skills | ||||

| ||||

| ||||

| 21 | ||||

| 23 |

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

Analysis of Risk Associated with Trustmark’s Compensation Policies and Practices | ||||

Human Resources Committee Interlocks and Insider Participation | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

Certain Defined Terms Used in Second Host Agreement and Dewey Agreement | 38 | |||

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR | ||||

DELINQUENT SECTION 16(a) | ||||

This summary highlights information contained elsewhere in this proxy statement. Please read the entire proxy statement carefully before voting as this is only a summary.

Information About the 2021 Annual Meeting

| Time/Date: | Tuesday, April 27, 2021, at 1:00 p.m. CT | |

Virtual Attendance: | www.virtualshareholdermeeting.com/TRMK2021You will be asked to enter your 16-digit control number printed in the box marked by the arrow on your proxy card or Notice of Internet Availability. | |

| Record Date: | March 1, 2021 | |

Proposal | Description | Board Recommendation | ||

Proposal 1 | Election of 12 directors to hold office for the ensuing year or until their | “FOR” (for each nominee) | ||

Proposal 2 | Advisory approval of Trustmark’s executive compensation | “FOR” | ||

Proposal 3 | Ratification of selection of Crowe LLP as Trustmark’s independent | “FOR” |

Corporate Governance Highlights

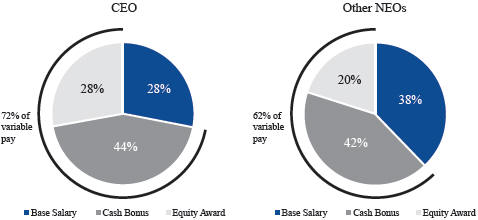

Executive Compensation Highlights

What we do:

| Substantial portion of executive pay based on performance against goals set by the Board | |

| Stock ownership requirements for executive officers | |

| Independent compensation consultant regularly advises the Human Resources Committee | |

| Minimum vesting periods of not less than three years for equity awards, with three-year cliff vesting of time-based awards | |

| Clawback provisions that permit Trustmark to recover incentive-based compensation under certain circumstances | |

| Use of peer company data to help set executive compensation | |

| Annual advisory votes on executive compensation | |

| Oversight of compensation by Human Resources Committee, which is comprised solely of independent directors | |

| What we don’t do: | ||

| No automatic or guaranteed annual salary increases | |

| No guaranteed bonuses or guaranteed long-term incentive awards | |

| No tax gross-ups for executive officers | |

| No “single-trigger” change in control severance payments | |

| No hedging of Trustmark stock | |

| No excessive perquisites | |

Corporate Social Responsibility

Trustmark Corporation (Trustmark) is holding its 20192021 Annual Meeting of Shareholders (the Annual Meeting) on Tuesday, April 23, 2019.27, 2021. This proxy statement is being sent on or about March 11, 2019,15, 2021, in connection with the solicitation by the Board of Directors of Trustmark (the Board) of proxies to be voted at the Annual Meeting and at any adjournment or postponement thereof.

Trustmark is furnishing this proxy statement over the Internet to most shareholders. These shareholders will not receive printed copies of the proxy statement and proxy card, and instead will receive a Notice of Internet Availability containing instructions on how to access the proxy materials over the Internet. If you received a Notice of Internet Availability, for additional information please see “Availability of Proxy Materials” on page 42.47 for additional information.

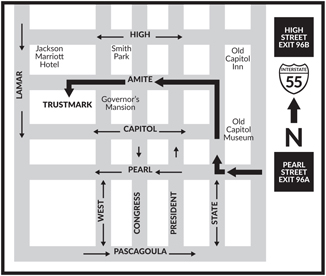

Meeting Location, Date and Time

The Annual Meeting will be held at Trustmark’s Corporate Office located at 248 East Capitol Street, Jackson, Mississippi 39201,in a virtual-only format on Tuesday, April 23, 2019,27, 2021, at 1:00 p.m. CT. Due to the public health impact of the COVID-19 pandemic and so that we may support the health and well-being of our associates, shareholders and the community, the Board has directed that the Annual Meeting be held virtually to allow remote participation by shareholders at the Annual Meeting. To obtain directions to attend the meeting contactvirtually and to vote and submit questions during the Secretary atAnnual Meeting, you may visit 1-601-208-5088www.virtualshareholdermeeting.com/TRMK2021 and enter the 16-digit control number printed in the box marked by the arrow on your proxy card or toll-free at1-800-844-2000printed on your voting instruction form, notice of internet availability of proxy materials, or email previously received. (extension 5088).

Shareholders of record at the close of business on March 1, 2019,2021, are entitled to notice of and to vote at the Annual Meeting in person or by proxy.Meeting. On the record date, Trustmark had outstanding 65,584,36363,537,431 shares of common stock.

A majority of the shares outstanding and entitled to vote constitutes a quorum to transact business at the Annual Meeting. Each share is entitled to one vote on each proposal.

The required vote for each proposal is as follows:

| ● | Directors must receive a majority of the votes cast in order to be elected (that is, the number of shares voted “for” a director must exceed the number of shares voted “against” that director). If a nominee who is an incumbent director is not elected, and no successor is elected, such nominee must tender his or her resignation |

| ● | The advisory vote to approve Trustmark’s executive compensation will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal. |

| ● | The ratification of the selection of Crowe LLP (Crowe) as independent auditor will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal. |

While abstentions and brokernon-votes are counted as shares present at the meeting for purposes of determining a quorum, they are not otherwise counted and, therefore, will have no effect on the outcome of the election of directors

or any other proposal.

Applicable rules determine whether proposals presented at shareholder meetings are considered routine ornon-routine. If a proposal is considered routine, a bank, broker or other holder of record which holds shares for an owner in street name generally may vote on the proposal without receiving voting instructions from the beneficial owner. If a proposal isnon-routine, the bank, broker or other holder of record generally may vote on the proposal only if the beneficial owner has provided voting instructions. A “brokernon-vote” occurs when a broker or other entity returns a signed proxy card but does not vote shares on a particular proposal because the proposal is not a routine matter and the broker or other entity has not received voting instructions from the beneficial owner of the shares. The ratification of the selection of Crowe as independent auditor is considered a routine matter, while the other proposals, i.e., the election of directors and the advisory vote to approve Trustmark’s executive compensation, are considerednon-routine matters.

All valid proxies received by Trustmark will be voted in accordance with the instructions indicated in such proxies. As noted above, if you hold your shares through a bank, broker or other holder of record and you do not give voting instructions, your bank, broker or other record holder of the shares is not permitted to vote your shares on any proposal other than Proposal 3, which is the only routine proposal on the agenda. If no instructions are indicated in an otherwise properly executed proxy, it will be voted FOR theeach director nomineesnominee named in Proposal 1, FOR advisory approval of Trustmark’s executive compensation in Proposal 2, FOR ratification of the selection of Crowe as independent auditor in Proposal 3 and on all other matters in accordance with the recommendations of the Board.

Shareholders of record can vote in person at the Annual Meeting or by proxy without attending the Annual Meeting.

To vote by proxy:

| (1) | Vote by Internet (instructions are on the Notice of Internet Availability or the proxy card), or |

| (2) | If you received a printed copy of this proxy statement, complete the enclosed proxy card and sign, date and return it in the enclosed postage-paid envelope. |

If you hold your shares through a bank, broker or other holder of record, your bank, broker or agentother holder of record will provide you with materials and instructions for voting your shares. If you hold your shares through a bank, broker or other holder of record, and you plan to vote in personyour shares at the Annual Meeting, you should contact yourcomplete the voting instructions form that the bank, broker or agentother holder of record will provide to obtain a legal proxyyou, or broker’s proxy card and bring ituse the telephone or Internet voting arrangements described on the voting instructions form or other materials that the bank, broker or other holder of record will provide to the meeting in order to vote in person.you.

You will receive multiple Notices of Internet Availability or printed copies of the proxy materials if you hold your shares in different ways (e.g., individually, by joint tenancy, through a trust or custodial account, etc.) or in multiple accounts. Please vote the shares represented by each Notice of Internet Availability or proxy card you receive to ensure that all of your shares are voted.

If you are a shareholder of record, you may revoke your proxy at any time before it isthe shares are voted by proxy during the meeting. A shareholder may revoke a proxy by delivering written notice to the Secretary at or prior to the Annual Meeting or by revocation at the meeting, bytimely delivery to the Secretary of a subsequently dated proxy card or by submitting a later vote by Internet (instructions are on the Notice of Internet Availability or the proxy card). In the case of multiple submissions regarding the same shares, the proxy with the latest date will be counted. The address for the Secretary is c/o Trustmark Corporation, Post Office Box 291, Jackson, MS 39205.

If you hold your shares through a bank, broker or other holder of record, andyour ability to revoke your proxy depends on the voting procedures of the bank, broker or other holder of record. Please follow the directions provided to you do not plan to vote in person at the Annual Meeting, you should contactby your bank, broker or agent to revoke your proxy or change your vote.other holder of record.

The Board is not aware of any additional matters to be brought before the meeting. If other matters do come before the meeting, the persons named in the accompanying proxy or their substitutes will vote the shares represented by such proxies in accordance with the recommendations of the Board.

Trustmark’s governance structure enables the Board to effectively and efficiently address key, specific issues such as business growth, human capital, enterprise risk management and technology, among others. This is accomplished through five standing Board committees and through the effective utilization of the directors’ combined wisdom and diverse experience and business knowledge.

The role of the Board and its committees is to foster Trustmark’s long-term success consistent with its fiduciary responsibilities

| ||||

● Providing strategic guidance and oversight | ● Ensuring that management’s operations contribute to Trustmark’s financial soundness | |||

● Acting as a resource on strategic issues and in matters of planning and policy-making | ● Promoting social responsibility and ethical business conduct | |||

● Providing insight and guidance on complex business issues and problems in the banking and financial services industries | ● Ensuring that an effective system is in place to facilitate the selection, succession planning and compensation of the Chief Executive Officer (CEO) | |||

● Monitoring risks facing Trustmark and providing oversight of Trustmark’s stress testing and other risk evaluation processes | ● Ensuring Trustmark’s compliance with all relevant legal and regulatory requirements | |||

On January 1, 2021, Gerard R. Host became Executive Chairman of Trustmark and Trustmark National Bank (the Bank), and Duane A. Dewey succeeded Mr. Host as President and CEO of Trustmark and CEO of the Bank and continued as President of the Bank. Richard H. Puckett remains as Chairman of the Executive and Nominating Committees and Lead Director of the Board and the Board of Directors of the Bank (the Bank Board). On March 1, 2021, Louis E. Greer retired as Treasurer, Principal Financial Officer and Principal Accounting Officer of Trustmark and Chief Financial Officer (CFO) of the Bank. Following Mr. Greer’s retirement, Thomas C. Owens succeeded Mr. Greer as Treasurer and Principal Financial Officer of Trustmark and CFO of the Bank. In addition, on March 1, 2021, George T. (Tom) Chambers, Jr. succeeded Mr. Greer as Principal Accounting Officer of Trustmark and became Chief Accounting Officer of the Bank, and Maria L. Sugay succeeded Mr. Owens as Bank Treasurer.

Key Features of Trustmark’s Corporate Governance

Trustmark’s governance structure has a number of key features that are designed to ensure effective and efficient oversight of the company, including the following:

| ● |

|

| ● | Directors are required to retire at the age of |

| ● | Directors are |

| ● | The Board has adopted, and annually reviews, formal charters for the Board and its committees to address the governance guidelines and responsibilities of each. |

| ● |

|

| ● | Directors must notify Trustmark of changes in professional responsibilities and residence and are expected to comply with a directors’ attendance policy. |

| ● | The Board has adopted codes of conduct/ethics for directors, senior financial officers |

| ● | The Board has the authority to seek advice or counsel from external advisors as needed. |

| ● | Trustmark has a CEO succession planning process to promote continuity of leadership and an orderly transition upon the CEO’s retirement or other termination of employment. |

| ● | Independent directors meet without management present. |

| ● | The Executive Committee of the Board reviews the corporate governance structure and annually evaluates each director’s performance against specific performance criteria designed to evaluate the director’s contributions to the Board’s deliberations and processes. |

In December 2018, the Board amended Trustmark’s bylaws to provide aone-year exception from the mandatory retirement age of 70 to permit Mr. Summerford to be nominated for election to an additionalone-year term as director following the completion of his current term at the 2019 Annual Meeting.

The Code of Conduct for Trustmark Directors, Code of Ethics for Senior Financial Officers of Trustmark, Code of Ethics and Procedure to Report Violations of Law or Accounting or Audit Irregularities (Whistleblower Procedures) are available on Trustmark’s website at www.trustmark.com underAbout Us/Investor Relations/Corporate Governance/ Governance Documentsinvestorrelations.trustmark.com or may be obtained, without charge, by written request addressed to the Secretary, Trustmark Corporation, Post Office Box 291, Jackson, MS 39205. Trustmark intends to provide required disclosure of any amendment to or waiver of its codes of conduct/ethics that applies to the principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, on www.trustmark.com underAbout Us/Investor Relations/Corporate Governance/Governance Documentsat investorrelations.trustmark.com promptly following any such amendment or waiver. Trustmark may also elect to disclose any such amendment or waiver in a report on Form8-K filed with the Securities and Exchange Commission (SEC). The information contained on or connected to Trustmark’s website is not incorporated by reference in this proxy statement and should not be considered part of this or any other document that Trustmark files with the SEC.

Meetings of the Board of Directors

The Board met sixeight times in 2018.2020. Each director attended at least 75% of the total number of meetings of the Board and Board committees of which the director was a member in 2018.2020. The Board generally meets jointly with the Bank Board, of Directors of Trustmark National Bank (Bank Board). Sinceand since 2017, all members of the Board have also served as members of the Bank Board.

Director Attendance at the Annual Meeting

Directors are expected to attend the annual meeting of shareholders, and in 2018,2020, all but one of our directors waswere present at the annual meeting.

The Board has determined that the following current directors and director nominees are “independent directors” (within the meaning of Rule 5605(a)(2) of the NASDAQNasdaq Listing Rules):

| Adolphus B. Baker | Tracy T. Conerly |

|

| |||||||

|

|

| ||||||||

| J. Clay Hays, Jr., M.D. |

| ||||||||

| William A. Brown | Toni D. Cooley | Harris V. Morrissette | ||||||||

| Augustus L. Collins | Marcelo Eduardo | Richard H. Puckett |

In conjunction with these independence determinations, the Board considered certain relationships, including through family members and business affiliates, that (i) Messrs. Brown and Puckett, and L. Walker,General Collins, Dr. Hays, Mrs. Conerly and Ms. Cooley have as customers of Trustmark National Bank (the Bank) and itsthe Bank’s subsidiary, Fisher Brown Bottrell Insurance, Inc. (Fisher Brown Bottrell) and (ii) Messrs. Baker, Brown, Compton,Eduardo and Puckett, General Collins and L. Walker, Dr. Hays and Ms. Cooley have as

customers of the wealth management and trust services division of the Bank. The Board also noted that a number of directors, including through business affiliates, have customer relationships with the Bank in the form of routine deposit, credit card and/or loan products in the ordinary course. In each case, the Board concluded that the business relationship did not interfere with the individual’s ability to exercise independent judgment as a director of Trustmark.

Under Trustmark’s governance guidelines, which are contained in the Board Charter, the Board has the responsibility to determine the most appropriate leadership structure for the company, including whether it is best for the company at a given point in time for the roles of Board Chairman and CEO to be separate or combined. Since May 2011,

Trustmark has had an independent Board Chairman. At this time, the Board believes that maintainingmaintained separate Board Chairman and CEO positions permitsfrom 2011 until 2020. Following the retirement of the prior Board Chairman at the 2020 annual meeting of shareholders, Trustmark combined the roles of Board Chairman and CEO in order to facilitate a smooth and seamless transition of both Board and executive leadership, consistent with Trustmark’s ongoing succession process. Mr. Host to focus on managing Trustmark’s business operations in his role as CEO while Mr. Summerford,served as Board Chairman maintains responsibility forand CEO through December 31, 2020. During this period of transition, the Board determined that Trustmark would benefit from Mr. Host occupying both roles while leading the Board in its oversight function and consideration of broader corporate strategy. As an independent BoardOn January 1, 2021, Mr. Dewey succeeded Mr. Host as CEO of Trustmark and the Bank, with Mr. Host becoming Executive Chairman of Trustmark and the Bank. In his role as Executive Chairman, Mr. Summerford, who has a broad business backgroundHost focuses on issues involving board governance, corporate strategy, corporate development, investor relations, industry engagement and has developed extensive managerial and leadership skills through his business career, can provide guidance to the CEO, set the agenda for Board meetings (in consultation with the CEO and other members of the Board), preside over meetings of the Board, and serve as the primary communicator between the directors and the CEO.civic leadership. The Board believes that this leadership structureMr. Host’s long tenure provides the appropriate balance betweenhim with valuable insights regarding Trustmark’s business, which enable him to offer strategic developmentadvice and independent oversight of management and that it is the most efficient and effective leadership structure for Trustmark at this time. This separation of the roles also fosters greater independence between the Board and management.guidance in his role as Executive Chairman.

In the future, if the CEO were to also serve as Board Chairman, the governance guidelines contained in Trustmark’s Board Charter and Bylaws provide that if the Board Chairman and CEO positions are occupied by the same individual or if the Board Chairman is otherwise not independent, chairmanan independent director shall serve as Chairman of the Executive Committee would serveas well as the Board’s Lead Director. Accordingly, Mr. Puckett has served as the Chairman of the Executive Committee and Lead Director with primary responsibility for chairing meetings.since the 2020 annual meeting of shareholders. The Lead Director would also be responsibleDirector’s responsibilities include (i) chairing meetings and executive sessions of the independent directors, Executive Committee and meetings on matters for which the Board Chairman recuses himself and other meetings in the Board Chairman’s absence, (ii) coordinating with the Board Chairman to develop Board meeting agendas and schedules, (iii) communicating with and advising the Board Chairman, (iv) referring to the appropriate Board committee any issue brought to his attention by shareholders, directors or others, and for(v) serving as the primary communicator between the independent directors and the CEO.CEO and (vi) providing an alternative communication channel for all directors, including non-executive directors. The Board believes an independent Lead Director serves an important function in providing independent leadership of the Board and strengthening the Board’s oversight of Trustmark’s business. The Board Charter is posted on Trustmark’s website at www.trustmark.com underAbout Us/Investor Relations/Corporate Governance/Governance Documents/Board Charter.investorrelations.trustmark.com.

Committees of the Board of Directors

There are five standing Board committees: Audit & Finance, Enterprise Risk, Executive, Human Resources and Nominating. All of these Board committees, other than the Nominating Committee, are joint committees of the Board and the Bank Board. The Audit & Finance, Human Resources and Nominating committees are comprised solely of independent directors and otherwise satisfy the requirements applicable to such committees under NASDAQNasdaq listing standards.

The Audit & Finance Committee meets regularly throughout the year including meeting with the external and internal auditors without management present. The Committee’s responsibilities include:

| ● | Sole responsibility for the appointment, compensation, retention and oversight of the work of the external auditor. |

| ● | Assuring the objectivity and independence of the internal audit department and the external auditor. |

| ● | Reviewing and concurring in the appointment, replacement, reassignment, performance or dismissal of the director of internal audit, who reports directly to the Committee. |

| ● | Inquiring of management, the director of internal audit, and the external auditor about significant risks or exposures and assessing steps that management has taken to minimize such risks to Trustmark. |

| ● | Considering and reviewing with the director of internal audit and the external auditor the adequacy of Trustmark’s internal controls. |

| ● | General oversight of the preparation and review of Trustmark’s consolidated financial statements, management’s discussion and analysis, critical accounting policies, interim financial statements, and other matters relating to financial reporting. |

| ● | Reviewing Trustmark’s annual budget and monitoring its performance. |

| ● | Oversight |

|

The role and responsibilities of the Audit & Finance Committee are described in greater detail in its Charter, which is posted on Trustmark’s website at www.trustmark.com underAbout Us/Investor Relations/Corporate Governance/ Governance Documents/Audit & Finance Committee Charter.investorrelations.trustmark.com.

The Enterprise Risk Committee is responsible for monitoring risks that are being taken by Trustmark. The Committee’s responsibilities include:

| ● | Understanding and analyzing the enterprise-wide effect of those risks. |

| ● | Reporting on risks to the Board. |

| ● | Monitoring capital stress testing results and comparison to risk appetite and other risk evaluation processes. |

| ● | Receiving reports from |

The Executive Committee acts on behalf of the Board if a matter requires Board action before a meeting of the Board can be held. The Committee’s responsibilities include:

| ● | Providing guidance to management on the strategic planning process and issues of strategic importance, including business growth and expansion, material transactions and technology. |

| ● | Oversight of Trustmark’s capital planning |

| ● | Oversight of Trustmark’s capital stress testing activities. |

| ● | Reviewing the corporate governance structure. |

| ● | Evaluating, annually, each director’s performance against specific performance criteria designed to evaluate the director’s contributions to the Board’s deliberations and processes. |

| ● |

|

The Human Resources Committee is responsible for overseeing the development of a program to compensate Trustmark’s management in accordance with Trustmark’s compensation philosophy and objectives. The Committee also ensures that appropriate policies and practices are in place to facilitate the development of management talent and orderly CEO succession. In fulfilling its role, the Committee’s responsibilities include:

| ● | Approving management-developed guidelines that shape Trustmark’s compensation strategy and approach. |

| ● | Recommending the skills and experience required of a CEO candidate, subject to final approval by the Board. |

| ● | Recommending the CEO’s compensation and performance evaluation procedures, for final approval by the Board. |

| ● | Recommending compensation for officers who are members of the Executive |

| ● | Recommending awards under Trustmark’s equity compensation plans, for final approval by the Board, subject to limited discretion by the CEO for specified awards. |

| ● | Recommending compensation for directors. |

| ● | Reviewing and approving Trustmark’s compensation disclosures. |

| ● | Overseeing the review of Trustmark’s compensation policies and practices as they relate to risk management. |

All members of the Committee during 20182020 and currently are“non-employee directors” within the meaning of Rule16b-3 under the Securities Exchange Act of 1934 (the Exchange Act), “outside directors” within the meaning of

Section 162(m) of the Internal Revenue Code of 1986, as amended, and “independent directors” within the meaning of Rule 5605(a)(2) of the NASDAQNasdaq listing rules. The Human Resources Committee Charter is posted on Trustmark’s website at www.trustmark.com underAbout Us/Investor Relations/Corporate Governance/Governance Documents/Human Resources Committee Charter.investorrelations.trustmark.com.

The Nominating Committee is charged with assisting the Board by identifying individuals qualified to become Board members. In fulfilling its role, the Committee’s responsibilities include:

| ● | Seeking, interviewing and recommending individuals for Board service. |

| ● |

|

| ● |

|

The Nominating Committee Charter is posted on Trustmark’s website at www.trustmark.com underAbout Us/ Investor Relations/Corporate Governance/Governance Documents/Nominating Committee Charter.investorrelations.trustmark.com.

Board Oversight of Risk Management

Trustmark believes that its governance and leadership structures allow the Board to provide effective risk oversight. In addition to the reports from the Enterprise Risk Committee, Trustmark’s directors receive and discuss regular reports prepared by Trustmark’s senior management, including the Chief Financial OfficerCFO and the Chief Risk Officer. Through these reports, Trustmark’s directors receive information on areas of material risk to the company, including credit, liquidity, market/interest rate, compliance, operational, technology, strategic, financial and reputational risks, and theserisks. These reports enable Trustmark’s directors to understand the risk identification, risk management and risk mitigation strategies employed by Trustmark’s management and the Enterprise Risk Committee. Since the first quarter of 2020, Trustmark’s directors have been receiving regular updates and reports from Trustmark’s senior management regarding various risks associated with the COVID-19 pandemic, including credit, liquidity, market/interest rate, and operational risk.

The Board and the Enterprise Risk Committee will request supplemental reports from Trustmark’s management with regard to risk management and risk mitigation strategies as appropriate. This reporting and governance structure ensures that information from the Enterprise Risk Committee, the other committees of the Board and the Bank Board, and management is analyzed and reported to the Board, and enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

As part of its overall oversight of risk management, the Board provides oversight of management’s efforts to address cybersecurity risk by receiving periodic reports at meetings of the Enterprise Risk Committee, and Audit & Finance Committee and Executive Committee, as well as presentations at the Board level. These reports to the Board and its Committees address the threat environment, vulnerability assessments, specific cyber incidents and management’s efforts to monitor, detect and prevent cyber threats.

The following table shows, for 2018,2020, the membership of each committee and the number of meetings held by each committee during the year:

| Director | Audit & Finance | Enterprise Risk | Executive | Human Resources | Nominating | |||||||||||

Adolphus B. Baker(1) | X | Chair | X | |||||||||||||

William A. Brown | X | X | ||||||||||||||

James N. Compton | X | X | ||||||||||||||

Tracy T. Conerly | Chair | X | X | |||||||||||||

Toni D. Cooley | Chair | X | X | |||||||||||||

J. Clay Hays Jr., M.D. | X | |||||||||||||||

Gerard R. Host | X | |||||||||||||||

John M. McCullouch(2) | X | X | X | |||||||||||||

Harris V. Morrissette(3) | X | X | X | |||||||||||||

Richard H. Puckett | X | X | X | |||||||||||||

R. Michael Summerford(4) | X | Chair | X | Chair | ||||||||||||

Harry M. Walker | ||||||||||||||||

LeRoy G. Walker, Jr. | X | |||||||||||||||

William G. Yates III | X | |||||||||||||||

2018 Meetings | 5 | 4 | 5 | 4 | 1 | |||||||||||

| Director | Audit & Finance | Enterprise Risk | Executive | Human Resources | Nominating | |||||

Adolphus B. Baker | X | Chair | X | |||||||

William A. Brown | X | X | ||||||||

Augustus L. Collins (1) | X | X | ||||||||

James N. Compton (2) | X | X | ||||||||

Tracy T. Conerly | Chair | X | X | |||||||

Toni D. Cooley | Chair | X | X | |||||||

Marcelo Eduardo (3) | X | |||||||||

J. Clay Hays Jr., M.D.(4) | X | X | ||||||||

Gerard R. Host | X | |||||||||

Harris V. Morrissette | X | X | ||||||||

Richard H. Puckett (5) | Chairman/Lead Director | X | Chair | |||||||

R. Michael Summerford (6) | X | X | X | |||||||

Harry M. Walker | X | |||||||||

LeRoy G. Walker, Jr. (7) | X | |||||||||

William G. Yates III | X | |||||||||

2020 Meetings | 5 | 4 | 6 | 6 | 3 | |||||

| (1) |

|

| (2) | Mr. |

| (3) | Mr. |

| (4) | Dr. Hays has served on the Human Resources Committee since April |

Mr. Puckett has served as Lead Director of the Board, Chairman of the Executive Committee and Chair of the Nominating Committee since April 28, 2020. |

| (6) | Mr. Summerford retired from the Board on April 28, 2020. Prior to his retirement, he served as Chairman of the Board, Chairman of the Executive Committee, Chair of the Nominating Committee and as a member of the Human Resources Committee. |

| (7) | Mr. L. Walker retired from the Board on April 28, 2020. Prior to his retirement, he served as a member of the Audit & Finance |

Shareholders desiring to contact Trustmark’s Board may do so by sending written correspondence to Board of Directors, Trustmark Corporation, Post Office Box 291, Jackson, MS 39205 or by email addressed to boardofdirectors@trustmark.com. Communications will be referred to the Chairman of the Executive Committee, who will determine the appropriate committee to receive the communication and take any action deemed necessary by that committee.

Pursuant to Trustmark’s Whistleblower Procedures, any violations of law or complaints or concerns regarding accounting or auditing matters should be reported to (i) Trustmark’s independent online reporting center at www.reportlineweb.com/Trustmark,trustmark, (ii) Trustmark’s independent Hotlinehotline at1-866-979-3769, or (iii) Trustmark’s Ethics Committee Chair at601-208-6867. Complaints will be investigated by Trustmark’s General Counsel and Director of Audit and reported to the Audit & Finance Committee.

Nominations for election to the Board may be made by or on behalf of the Board or by any shareholder of any outstanding class of capital stock of Trustmark entitled to vote in the election of directors at an annual meeting.

Nominations other than those made by or on behalf of the Board must be made in accordance with procedures set forth in Trustmark’s bylaws. These procedures require that such nominations be in writing and that they be delivered or mailed to Trustmark’s Chairman and received (a) not less than 60 days nor more than 90 days prior to the first anniversary of the mailing date of Trustmark’s proxy statement in connection with the last annual meeting of shareholders, or (b) if no annual meeting was held in the prior year or the date of the annual meeting has been changed by more than 30 days from the date of the prior year’s annual meeting, not less than 90 days before the date of the annual meeting. The bylaws also require that such notification contain the following information to the extent known to the notifying shareholder: (a) the name and address of each proposed nominee, (b) the principal occupation of each proposed nominee, (c) the total number of shares of capital stock of Trustmark that will be voted for each proposed nominee, (d) the name and residence address of the notifying shareholder, (e) the number of shares of capital stock of Trustmark owned by the notifying shareholder, (f) such other information regarding such proposed nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the proposed nominee been nominated by the Board, (g) a representation that the notifying shareholder is the owner of shares entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the proposed nominee, and (h) the written consent of each proposed nominee to serve as a director of Trustmark if so elected.

Nominations not made in accordance with the above bylaw procedure may be disregarded by the Chairman of the annual meeting at his discretion, and upon his instruction, all votes cast for each such nominee may be disregarded.

Trustmark’s bylaws permit direct nominations by shareholders. Therefore, the Nominating Committee does not have a policy for considering nominations by shareholders other than through the bylaw process outlined above. However, if a shareholder wishes to recommend an individual for Board service, rather than directly nominate the individual as set forth above, the shareholder may submit the individual’s name to the Nominating Committee in writing addressed to Trustmark Corporation Nominating Committee, Post Office Box 291, Jackson, MS 39205 or by email to boardofdirectors@trustmark.com. In order to give the Nominating Committee adequate time to consider any such individual for nomination as a director at the 20202022 Annual Meeting of Shareholders, such recommendations should be delivered no later than October 1, 2019.2021. In considering an individual recommended by a shareholder but not directly nominated, the Nominating Committee will use the same guidelines as set forth in the Director Qualifications section below.

When identifying potential candidates for director nominees, the Nominating Committee may solicit suggestions from incumbent directors, management or others. All nominees at

Corporate Social Responsibility

Trustmark is committed to fulfilling its responsibilities to its associates, customers, communities and shareholders. Trustmark believes building strong customer relationships is the Annual Meetingresult of knowing its customers and supporting its communities. Robust community engagement, volunteerism, and philanthropy are current Board members.some of the ways in which Trustmark continues to serve its communities. Trustmark is also committed to diversity and social inclusion throughout the organization and supports practices that encourage environmental sustainability. In furtherance of these commitments, Trustmark appointed a Director of Corporate Social Responsibility in 2020 to advance its efforts.

In 2020, Trustmark invested $5.3 million in the form of contributions and sponsorships to local organizations, including $1.5 million given to Mississippi youth and family-based charities providing services and programs for the welfare and development of children as part of Trustmark’s commitment under the Mississippi Children’s Promise

Act. In response to community needs that surfaced because of the COVID-19 pandemic, Trustmark contributed more than $400,000 to support local food pantries throughout its service areas. Additional contributions included funds for school supplies and computer headsets to support virtual learning.

Trustmark continued to focus on financial literacy, partnering with EVERFI, Inc. to provide online financial literacy courses in approximately 100 schools, educating 9,500 students on financial matters through Trustmark’s Financial Scholars Program. During the year, Trustmark expanded its relationship with EVERFI to utilize the Engage platform, which will allow Trustmark associates to conduct community-based financial literacy sessions, both in-person and virtually.

Trustmark also partnered with Operation HOPE, Inc., a national non-profit organization, to provide financial literacy and counseling support to individuals within the Memphis, Tennessee market. This partnership, called HOPE Inside, provides over 5,000 City of Memphis employees with opportunities to receive financial tools and education to strengthen their financial security. Trustmark committed $200,000 to the two-year partnership, providing a dedicated financial wellness coach to conduct financial literacy seminars, individualized counseling sessions and referrals to disaster relief services. In 2020, more than 1,200 services were provided through this partnership. In recognition of the anticipated long-term impact of the program, Trustmark developed plans to replicate the partnership with Operation HOPE and city governments in the Montgomery, Alabama and Jackson, Mississippi markets in 2021.

Trustmark’s commitment to building and supporting resilient communities includes revitalizing and strengthening underserved communities. Its investments in low-to-moderate income areas included more than $211 million in home mortgage loans and $139 million in small business loans and small farm loans in 2020 and approximately $85 million in community development loans. Also in 2020, Trustmark provided low-to-moderate income borrowers more than $436 million in home mortgage loans. The company’s collaborative work with community service providers, developers, realtors, housing advocates and others resulted in more than $16 million in investments that provide affordable housing, employment and community services for those with low-to-moderate incomes. Trustmark also enhanced its mortgage product offerings during the year to meet the special credit needs of low-to-moderate income individuals and communities.

During 2020, Trustmark promoted environmental sustainability with the sponsorship of numerous community shredding events to encourage recycling initiatives. Additionally, an LED light conversion project was continued across the organization to increase energy efficiency.

Collectively, these efforts reflect Trustmark’s core values of Integrity, Service, Accountability, Relationships and Solutions and its commitment to strengthen the communities it serves.

The Board believes that in order to appropriately carry out its roles, directors must demonstrate a variety of personal traits, leadership qualities and individual competencies. In considering nominees submitted by the Board or management and any recommendations submitted by shareholders, the Nominating Committee will use these personal traits, leadership qualities and individual competencies to assess future director nominees’ suitability for Board service. The Nominating Committee also evaluates each director nominee’s qualities in the context of how that nominee would relate to the Board as a whole, in light of the Board’s current composition and Trustmark’s evolving needs.

Although Trustmark has no formal policy regarding diversity, the Nominating Committee believes that the Board should include directors with diverse skills, experience and business knowledge, and whose backgrounds, ages, geographical representation and community involvement contribute to an overall diversity of perspective that enhances the quality of the Board’s deliberations and decisions. The Nominating Committee may consider these factors as it deems appropriate in connection with the general qualifications of each director nominee.

Board service is an extremely important, high profile role and carries with it significant responsibility. For that reason, it is important that all directors possess a certain set of personal traits, including:

● | Personal and Professional Integrity | ● | High Performance Standards | |||

● | Accountability | ● |

| |||

● | Informed Business Judgment | ● | Business Credibility | |||

● | Mature Confidence |

For individuals considered for Board leadership roles, the following skill sets are required:

● | Communication Skills | ● | Facilitation Skills | |||

● | Crisis Management Skills | ● | Relationship Building/Networking Skills |

There are certain competencies that must be represented collectively by the directors on each Board committee, but each individual director need not necessarily possess all of them. The specific competencies vary by committee, as illustrated in the chart below:

| Individual Director Competencies | Board Committees | |||||||||||||||||||

Finance |

Enterprise Risk | Executive |

Resources |

|

| Nominating | ||||||||||||||

1. Financial Acumen | ||||||||||||||||||||

Accounting and finance knowledge | ||||||||||||||||||||

Financial statement analysis | ||||||||||||||||||||

Knowledge of capital markets | ||||||||||||||||||||

Financial planning | ||||||||||||||||||||

Ability to communicate financial concepts in lay terms | ||||||||||||||||||||

2. Organizational Effectiveness | ||||||||||||||||||||

Talent management | ||||||||||||||||||||

Understanding of compensation issues | ||||||||||||||||||||

Ability to discern candidate qualifications | ||||||||||||||||||||

3. Strategic Direction | ||||||||||||||||||||

Vision | ||||||||||||||||||||

Strategic perspective | ||||||||||||||||||||

Technology knowledge | ||||||||||||||||||||

Industry knowledge | ||||||||||||||||||||

4. Risk Management Experience | ||||||||||||||||||||

Experience managing risk exposures | ||||||||||||||||||||

Specific Director Experience, Qualifications, Attributes and Skills

The Board believes that each person nominated for election at the Annual Meeting possesses the personal traits described above and that each director nominee who has served in a position of Board leadership also demonstrates the additional leadership qualities described above. In considering the director nominees’ individual competencies, the Board believes that the appropriate competencies are represented for the Board as a whole and for each of the Board’s committees. In addition, each nominee possesses characteristics that led the Board to conclude that such person should serve as a director. The specific experience, qualifications, attributes and skills that the Board believes each nominee possesses are discussed under Proposal 1 in the table entitled “The Nominees,” beginning on page 9.12.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board has fixed the number of directors for the coming year at 13.12. The nominees listed herein have been proposed by the Board for election at the Annual Meeting. Mr. Walker will retire at the Annual Meeting. Shares represented by valid proxies will, unless authority to vote is withheld, be voted in favor of the proposed slate of 1312 nominees. Directors must receive a majority of the votes cast in order to be elected (that is, the number of shares voted “for” a director must exceed the number of shares voted “against” that director). If a nominee who is an incumbent director is not elected to the Board, and no successor is elected, such nominee must tender his or her resignation to the Board. The Nominating Committee will then make a recommendation to the Board on whether to accept or reject the resignation or whether to take other action. The director who tenders his or her resignation may not participate in the recommendation of the Nominating Committee or the decision of the Board with respect to his or her resignation. Each director is elected to hold office until the next annual meeting of shareholders or until a successor is elected and qualified.

The Board recommends that shareholders vote “for” the proposed nominees.

|

Adolphus B. Baker,

Director of Trustmark since 2007 (Independent Director)

Trustmark Corporation Committees:

● Executive ● Human Resources (Chair) ● Nominating |

Career Highlights:

● Chairman and CEO, Cal-Maine Foods, Inc. (Producer and Distributor of Shell Eggs)

Other Public Company Boards:

● Cal-Maine Foods, Inc. |

Experience and qualifications:Mr. Baker’s position as chairman and chief executive officer of another publicly-traded company has provided him with significant business leadership skills and experience in evaluating strategic alternatives that focus on maximizing shareholder value. Mr. Baker’s years of service as a director for Trustmark National Bank, and particularly as the former chairman of the Bank Board’s Asset Liability Committee, provide him with an intrinsic understanding of Trustmark’s strategy for managing liquidity, which is a skill essential to the Board’s risk oversight function.

| ||||

|

William A. Brown,

Director of Trustmark since 2017 (Independent Director)

Trustmark Corporation Committees:

● Audit & Finance ● Enterprise Risk |

Career Highlights:

● President and CEO, Brown Bottling Group, Inc. (Beverage Distributor) | ||

Experience and qualifications: Mr. Brown serves as president and chief executive officer of a regional beverage distributor based in Mississippi. He serves on the Boards of the Pepsi Cola Bottlers Association and Wis-Pak/WP Beverages.

Experience and qualifications: Mr. Brown serves as president and chief executive officer of a regional beverage distributor based in Mississippi. He serves on the Boards of the Pepsi Cola Bottlers Association and Wis-Pak/WP Beverages as well as trade associations, including the Mississippi Beverage Association. His extensive experience in this industry has provided him with significant marketing and business leadership skills as well asin-depth understanding of the business climate and customer base in significant Trustmark markets. Mr. Brown has also served on the Bank Board’s Credit Policy Committee, providing him with an understanding of Trustmark’s credit culture and philosophy, which is a skill essential to the Board’s risk oversight function. | ||||

| Augustus L. Collins, 63 Director of Trustmark since 2020 (Independent Director) Trustmark Corporation Committees: ● Audit & Finance ● Enterprise Risk | Career Highlights: ● CEO, MINACT Inc. (Job Training, Development and Management) Other Public Company Boards: ● Huntington Ingalls Industries | ||

Experience and qualifications: General Collins has served as the CEO of MINACT Inc., a job training, development and management company, since 2016. He retired with the rank of Major General in the Mississippi National Guard, having served as Adjutant General of both the Mississippi Army National Guard and the Mississippi Air National Guard from 2012 to 2016. His 35 years of combined military service in the U.S. Army and the Mississippi National Guard included the command of the 155th Brigade Combat Team in Iraq, where he was responsible for security operations in the southern and western provinces. He was previously appointed by the Governor to the Mississippi Workers’ Compensation Commission where he served as the commission’s representative of labor. General Collins’ years of service and leadership provide him with valuable experience in strategic and financial planning as well as human resources. | ||||

| Tracy T. Conerly, 56 Director of Trustmark since 2015 (Independent Director) Trustmark Corporation Committees: ● Audit & Finance (Chair) ● Executive ● Nominating | Career Highlights: ● Partner Emeritus, Carr, Riggs & Ingram, LLC (Accounting) | ||

Experience and qualifications: Mrs. Conerly is a certified public accountant and a certified valuation analyst. Her experience as a former partner at a large certified public accounting firm and former director of a publicly traded financial institution, which was acquired by Trustmark in 2013, has provided her with significant financial and accounting expertise, particularly in the areas of auditing, business valuation and tax, and qualifies her for service as one of the Board’s audit committee financial experts. Mrs. Conerly’s years of service as a director of a publicly traded financial institution provide her with valuable experience in financial institution governance and an understanding of markets that are a strategic focus for Trustmark. Mrs. Conerly also serves on the Bank Board’s Asset/Liability Committee, providing her with an understanding of Trustmark’s balance sheet strategy, which is a skill essential to the Board’s risk oversight function. She is a member of the National Association of Corporate Directors. | ||||

| Director of Trustmark since

| (

|

Experience and qualifications: Mr. Compton serves as president and chief executive officer of a member-owned,not-for-profit electric generation and transmission cooperative that supplies wholesale electricity and other services to its members. Mr. Compton’s legal background and business acumen provide him with the skills necessary to contribute invaluable insight and broad perspective to Board discussions and qualifies him for service as one of the Board’s audit committee financial experts. In addition, Mr. Compton continues to serve on the Bank Board’s Asset Liability Committee, which provides him with a solid understanding of Trustmark’s balance sheet strategy.

|

Trustmark Corporation Committees:

● ● Executive

|

|

Experience and qualifications:Mrs. Conerly’s experience as a former partner at a large certified public accounting firm and former director of BancTrust Financial Group, Inc. (BancTrust), which was acquired by Trustmark in 2013, has provided her with significant financial and accounting expertise, particularly in the areas of auditing and tax, and qualifies her for service as one of the Board’s audit committee financial experts. Mrs. Conerly’s years of service as a director of BancTrust, and BancTrust’s subsidiary banks in Alabama and Florida, provide her with valuable experience in financial institution governance and an understanding of markets that are a strategic focus for Trustmark. Mrs. Conerly has also served on the Bank Board’s Asset Liability Committee, providing her with an understanding of Trustmark’s balance sheet strategy, which is a skill essential to the Board’s risk oversight function.

|

● Nominating | Career Highlights: ● CEO, Systems Electro Coating (Provider of Electrocoating and Related Services to Original Equipment Manufacturers)

Other Public Company Boards: ● Sanderson Farms, Inc. |

Experience and qualifications:Ms. Cooley is the chief executive officer of the Systems Group of Companies, which includes Systems Electro Coating, a Tier One supplier to Nissan, and Systems Automotive Interiors, a Tier One supplier to Toyota. She holds a Juris Doctor degree and is a director for another publicly-traded company as well as several nonpublic organizations. She was appointed a director of the Federal Reserve Bank of Atlanta, New Orleans Branch, in 2019. In addition, Ms. Cooley has served on the Bank Board’s Credit Policy Committee, which has given her a solid understanding of Trustmark’s core business and conservative values. Her leadership experience and business knowledge, with expertise in fields ranging from law to operations and technology, equip Ms. Cooley with the ability to contribute invaluable insight and broad perspective to Board discussions. | ||||

| Duane A. Dewey, 62 Director of Trustmark since 2020 Trustmark Corporation Committees: ● Executive | Career Highlights: ● President and Chief Executive Officer, Trustmark Corporation ● President and Chief Executive Officer, Trustmark National Bank |

Experience and qualifications: Mr. Dewey became president and chief executive officer of Trustmark and the Bank on January 1, 2021. He was formerly president and chief operating officer of the Bank from January 1, 2020, to December 31, 2020. He served as chief operating officer of the Bank from January 1, 2019, to December 31, 2019, and as President of Corporate Banking from 2008 to 2018. Mr. Dewey, with 18 years of experience at Trustmark and 36 years in the financial services industry, has worked in diverse geographic markets and in numerous lines of banking businesses. His executive management responsibilities in retail and institutional banking, mortgage, wealth management and insurance services enable him to provide valuable operational, strategic and financial perspectives to the Board. | ||||

| Marcelo Eduardo, 58 Director of Trustmark since 2020 (Independent Director) Trustmark Corporation Committees: ● Audit & Finance | Career Highlights: ● Dean, School of Business, Mississippi College |

Experience and qualifications: Mr. Eduardo has served as the Dean of the School of Business at a private college in Mississippi since 2003. He holds Ph.D. (Finance) and MBA degrees and serves as the Anderson Distinguished Professor of Finance at Mississippi College. Mr. Eduardo, an accomplished academic, has authored numerous articles on a variety of topics, including investment management, compliance, capital management and the pricing of retail banking services, which have been published in national and international journals. His expertise in banking and corporate finance, combined with his proven marketing and leadership skills, will provide valuable marketing, strategic and financial perspectives to the Board. Mr. Eduardo also serves on the Bank Board’s Asset/Liability Committee. | ||

| J. Clay Hays, Jr., M.D.,

Director of Trustmark since 2017 (Independent Director)

Trustmark Corporation Committees:

● Enterprise Risk ● Human Resources | Career Highlights:

● Cardiologist, Partner, President, Jackson |

Experience and qualifications: Dr. Hays is president of Jackson Heart Clinic, PA, one of the largest cardiology groups in Mississippi. He is the executive medical director and chairman of the Mississippi Heart and Vascular Institute of St. Dominic’s Hospital, president elect of the Mississippi State Medical Association, chairman of the Mississippi Healthcare Solutions Institute and secretary of Medical Assurance Company of Mississippi, a statewide medical malpractice insurer. With extensive experience in the medical industry, Dr. Hays is uniquely positioned to advise Trustmark on the healthcare industry. Dr. Hays also serves on the Bank Board’s Asset

Experience and qualifications: Dr. Hays is president of Jackson Heart Clinic, PA, one of the largest cardiology groups in Mississippi. He serves as chairman of the Mississippi Healthcare Solutions Institute and as director and secretary of the Medical Assurance Company of Mississippi, a statewide medical malpractice insurer. He is also a director and immediate past president of the Mississippi State Medical Association. With extensive experience in the medical industry, Dr. Hays is uniquely positioned to advise Trustmark on the healthcare industry. Dr. Hays also serves on the Bank Board’s Asset/Liability Committee. | ||||

| Gerard R. Host, 66 Director of Trustmark since 2010 Chairman of Trustmark Board from April 2020 to December 2020 Executive Chairman of Trustmark Board since January 2021

Trustmark Corporation Committees: ● Executive | Career Highlights:

● Executive Chairman, Trustmark Corporation and Trustmark National Bank ● Former President and CEO, Trustmark Corporation ● Former President and CEO, Trustmark National Bank

|

Experience and qualifications:Mr. Host became president and chief executive officer of Trustmark Corporation and Trustmark National Bank, effective January 1, 2011, having served as president and chief operating officer of Trustmark National Bank prior to that time. He served as a director of the Federal Reserve Bank of Atlanta from 2012 until the end of his second term on December 31, 2018. Throughout his35-year tenure with Trustmark, Mr. Host has served in a variety of executive management capacities, including chief financial officer, chief investment officer and president of various divisions. Mr. Host’sin-depth knowledge of Trustmark’s operations and of the financial services industry enables him to provide both historical and strategic perspectives in Board discussions regarding corporate strategy and governance matters.

Experience and qualifications: Mr. Host became Executive Chairman of Trustmark and the Bank on January 1, 2021. Mr. Host served as president and chief executive officer of Trustmark and chief executive officer of the Bank from January 1, 2011, to December 31, 2020, and served as president of the Bank from 2011 to December 31, 2019. He also served as a director of the Federal Reserve Bank of Atlanta from 2012 until the end of his second term on December 31, 2018. Throughout his 37-year tenure with Trustmark, Mr. Host has served in a variety of executive management capacities, including chief financial officer, chief investment officer and president of various divisions. Mr. Host’s in-depth knowledge of Trustmark’s operations and of the financial services industry enables him to provide both historical and strategic perspectives in Board discussions regarding corporate strategy and governance matters. Mr. Host will continue to serve as Executive Chairman of the Trustmark Board following the Annual Meeting. | ||||

| Harris V. Morrissette,

Director of Trustmark since 2016 (Independent Director)

Trustmark Corporation Committees:

● Audit & Finance ● Human Resources | Career Highlights:

● President, China Doll Rice & Beans, Inc. ● Former President and CEO,

Other Directorships:

● Williamsburg Investment Trust |

Experience and qualifications: Mr. Morrissette serves as the president of a regional packaged food and food services company based in Alabama. His extensive experience in this industry has provided him with significant marketing and business leadership skills. He also serves on the Bank Board’s Credit Policy Committee. Mr. Morrissette’s years of service as a director of BancTrust, and BancTrust’s subsidiary banks in Alabama and Florida,

Experience and qualifications: Mr. Morrissette serves as the president of a regional packaged food and food services company based in Alabama. His prior years of service as a director of a publicly-traded financial institution provide him with valuable experience in financial institution governance and an understanding of markets that are a strategic focus for Trustmark. In addition, Mr. Morrissette’s background and business acumen provide him with the skills necessary to contribute invaluable insight and broad perspectives to Board discussions and qualify him for service as one of the Board’s audit committee financial experts. He also serves on the Bank Board’s Credit Policy Committee.

| ||||||

| Richard H. Puckett,

Director of Trustmark since 1995 Lead Director of Trustmark since 2020 (Independent Director) Trustmark Corporation Committees: ● Executive (Chairman) ● Human Resources ● Nominating (Chair) | Career Highlights:

● Chairman and CEO, Puckett Machinery (Distributor of Heavy Earth Moving |

Experience and qualifications:Mr. Puckett is the chairman and chief executive officer of a heavy equipment distribution and rental company with facilities located in Mississippi and eastern Louisiana that provide heavy equipment, engine power solutions and related supplies to a variety of industries. Mr. Puckett brings marketing and business leadership skills to the Board, as well as anin-depth understanding of the business climate and customer base in Trustmark’s major legacy markets. His experience and Board tenure provide valuable perspective to his service as Chair of the Bank Board’s Credit Policy Committee. | ||||

|

|

|

Experience and qualifications:Mr. Summerford has served as the president and chief operating officer and chief financial officer of another publicly-traded company. He was also a certified public accountant. His career experience has resulted in Mr. Summerford’s expertise in understanding financial statements, accounting methodologies and compensation practices, which is essential to his service on the Human Resources Committee. His extensive business background has equipped him with the leadership and consensus-building skills necessary to serve as Chairman of the Board and of the Executive Committee.

|

|

|

Experience and qualifications: Mr. Walker has extensive banking and financial services experience, having retired after serving 44 years at Trustmark in numerous leadership positions, including Chief Lending Officer and President of the Central Mississippi Region. Mr. Walker’s long-standing history with Trustmark, including his membership on the Board of Directors of Trustmark National Bank, provides a valuable source of knowledge and stability to the Bank Board’s Asset Liability Committee, which he chairs and the Credit Policy Committee on which he serves.

|

Director of Trustmark since 2009

Trustmark Corporation Committees:

|

|

Experience and qualifications:Mr. Walker has many years of experience in retail Quick Service Restaurant consulting and is a former owner/operator of a franchise of a major national restaurant chain. Mr. Walker’s experience in this regard has provided him with a unique and broad perspective of marketing and customer needs. His business skills and experiences on numerous nonpublic and civic boards demonstrate his ability to work successfully as part of a team and enable him to contribute diverse perspectives to Board discussions. Mr. Walker also serves on the Bank Board’s Asset Liability Committee and Credit Policy Committee.

|

● Enterprise Risk | Career Highlights:

● President and CEO, W.G. Yates & Sons |

Experience and qualifications:Mr. Yates is the president and chief executive officer of a commercial construction company with operating divisions located throughout the Southeast, many of which are within markets served by Trustmark. Mr. Yates’ knowledge of these markets, as well as his leadership experience in the various aspects of the construction industry, including employee relations matters, contract negotiations and risk management, provide the Board with an important resource for assessing and managing risks and planning for corporate strategy. He is also a member of the Bank Board’s Credit Policy Committee.

Experience and qualifications: Mr. Yates is the president and chief executive officer of a commercial construction company with operating divisions located throughout the Southeast, many of which are within markets served by Trustmark. Mr. Yates’ knowledge of these markets, as well as his leadership experience in the various aspects of the construction industry, including employee relations matters, contract negotiations and risk management, provide the Board with an important resource for assessing and managing risks and planning for corporate strategy. He is also a member of the Bank Board’s Credit Policy Committee. In January 2021, Mr. Yates was appointed a director of the Federal Reserve Bank of Atlanta, New Orleans Branch. In addition, he serves as a director and is former chairman of the Mississippi Economic Counsel. | ||||

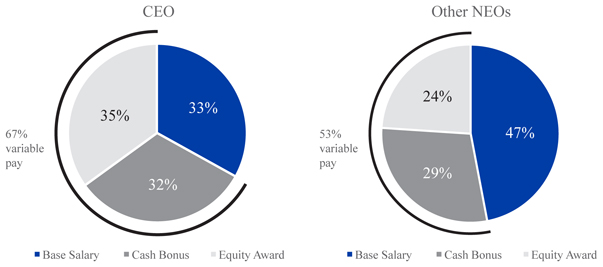

Compensation Discussion and Analysis

Guiding Philosophy.The guiding philosophy of the Human Resources Committee of the Board (the Committee) is to attract and retain highly qualified executives and to motivate them to maximize shareholder value while managing risk appropriately and maintaining the safety and soundness of the organization. The Committee believes that executive compensation should be linked to Trustmark’s performance and significantly aligned with both the short-term and long-term interests of Trustmark’s shareholders. The Committee also believes that executive compensation should be designed to allow Trustmark to recruit, retain and motivate employees who play a significant role in the organization’s current and future success. Further, compensation policies and practices should be designed to help develop management talent, promote teamwork among, and high morale with, executive management, establish effective corporate governance, and set compensation at competitive levels.

Trustmark’s compensation policies and practices reflect the Committee’s guiding philosophy, as shown below:

What we do:

✓ | Substantial portion of executive pay based on |

| ||||||||

performance against goals set by the Board | ||||||||||

|

| ||||

✓ | Stock ownership requirements for executive officers |

✓ | Independent compensation consultant regularly |

| ||||||||

| advises the Committee |

| ||||||||||

✓ | Minimum vesting periods of not less than three years | |||||||||

| for equity awards, with three-year cliff vesting of time-based awards |

| ||||||||||

✓ | Clawback provisions that permit Trustmark to |

| ||||||||

| recover incentive-based compensation under certain circumstances |

✓ | Use of peer company data to help set executive compensation |

✓ | Annual advisory votes on executive compensation |

| ✓ | Oversight of compensation by the Human Resources Committee, which is comprised solely of independent directors |

What we don’t do:

| ✗ | No automatic or guaranteed annual salary increases |

| ✗ | No guaranteed bonuses or guaranteed long-term incentive awards |

| ✗ | No tax gross-ups for executive officers |

| ✗ |

| ✗ | No hedging of Trustmark stock |

| ✗ | No excessive perquisites |

Key Elements of Compensation.The following table summarizes key elements of Trustmark’s executive compensation program and the primary objectives each element supports. The Committee believes these elements are standard compensation components for named executive officers (NEOs) at Trustmark’s peer companies:

| Key Elements | Objectives | |||

Base salary | ● | Attract and retain highly qualified executives | ||

| ● | Reward prior performance, industry and job specific | |||

knowledge, experience and leadership ability

| ||||

Annual cash bonuses | ● | Reward achievement of annual corporate goals and, where applicable,line-of-business goals

| ||

Performance-based restricted stock | ● | Reward achievement of long-term objectives | ||

| ● | Create a direct link between management’s performance and | |||

shareholder value

| ||||

Time-based restricted stock | Align shareholder and management interests | |||

| ● |

| |||

| ● | Supports achievement of stock ownership goals

| |||

Changes to Executive Compensation Program in 2018.In 2017, the Committee undertook a comprehensive review of Trustmark’s executive compensation program, and engaged its independent compensation consultant, Pearl Meyer & Partners, LLC (Pearl Meyer), to provide the Committee with a report containing current market data regarding executive compensation in the banking and financial services industry. The report also assessed the competitiveness of Trustmark’s executive compensation and the alignment of pay with performance, and recommended for certain changes in Trustmark’s executive compensation program. Pearl Meyer concluded that compensation for Trustmark’s named executive officers was generally below the median

market values for comparable positions, and, in some cases, significantly below median market values. Pearl Meyer also determined that Trustmark’s executive compensation was fairly well-aligned with the company’s performance, relative to peers, but that Trustmark could have paid more in some periods without negatively impacting the alignment of pay for performance.

Key changes for 2018 are summarized below.

Making Trustmark’s Executive Pay Levels and Mix of Pay More Competitive with the Market.The following changes were driven primarily by the Committee’s desire to make Trustmark’s executive compensation, including the mix of pay, more competitive with the market for comparable positions:

|

|

Enhancing Alignment of Pay and Performance.The following changes were primarily driven by the Committee’s desire to enhance the alignment between pay and performance.

|

|

Enhancing Retention and Long-Term Stock Ownership by Executives.The split of annual LTI awards was changed from 33% time-based and 67% performance-based to 50% for each. The Committee made this change to enhance the retention effect of the LTI awards, which have a three-year cliff vesting feature, and to place more emphasis on encouraging greater stock ownership over the long term. At the same time, the time-based awards have an incentive effect since their value depends on Trustmark’s stock price.